Car finance is crucial for anyone looking to purchase a vehicle without breaking the bank.

By understanding different options and making informed choices, you can easily navigate through the complexities of financing your next car.

Understanding Car Finance

Understanding car finance is essential for anyone looking to buy a vehicle. It involves knowing how to budget and manage your finances, ensuring that you make the best choices for your situation.

There are different types of car finance options available, such as loans, financing plans, and leasing. Each option has its own advantages and disadvantages, and it’s important to understand these to select the right fit.

A basic understanding of how interest rates work and how they affect your monthly payments can save you a lot of money in the long run. Knowing your credit score is also vital, as it can impact the terms of your finance deal considerably.

When considering car finance, it’s advisable to shop around for the best deals. Comparing offers from different lenders or dealerships can help you find lower interest rates and better repayment terms.

Another aspect to ponder is the long-term cost of car ownership, which includes maintenance, insurance, and potential resale value. Properly evaluating these factors can help you make an informed decision and avoid financial strain.

Overall, becoming familiar with car finance prepares you to tackle the challenges that come with purchasing a car, paving the way for a smooth and satisfying experience.

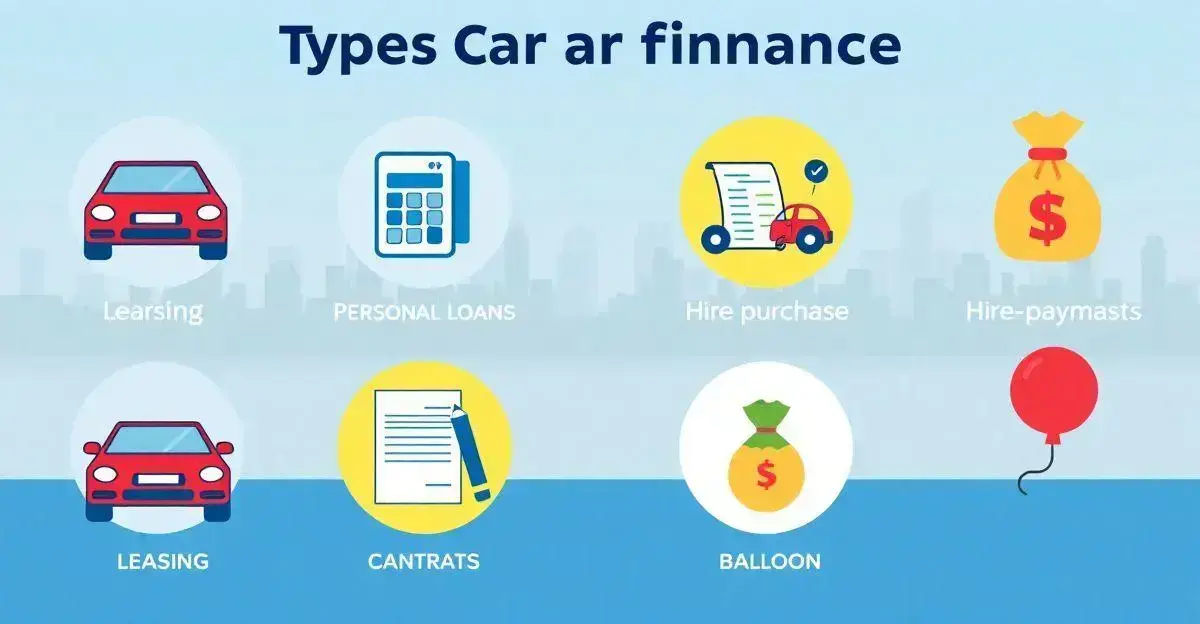

Types of Car Finance Available

When looking for car finance, it’s important to understand the various types available. Each type of finance serves different needs and situations, catering to both individual preferences and financial capabilities.

One common option is a car loan. This involves borrowing money from a bank or lender to buy a vehicle outright. You will pay back the loan amount in fixed monthly installments, along with interest over a set period. Once paid off, you own the car completely.

Another option is leasing. Instead of buying the car, you rent it for a specified time, usually 2 to 4 years. Leasing often results in lower monthly payments compared to a loan, but at the end of the lease, you do not own the vehicle.

Hire purchase is similar to a loan, but with this option, you don’t own the car until the last payment is made. This means you can use the car while repaying, but technically, the lender owns the vehicle until then.

Personal contract purchase (PCP) is another popular choice. This involves lower monthly payments and the option to buy the car at the end of the term for a predetermined amount. PCP is appealing for those who like a new car every few years.

Lastly, there are specialty financing options, like those for bad credit borrowers. These may come with higher interest rates but can provide access to car finance for individuals who would otherwise be turned away.

Understanding these various types of car finance will help you make informed decisions when purchasing your next vehicle.

How to Choose the Right Car Finance Option

Choosing the right car finance option is crucial for making a smart purchase. With so many choices available, understanding what each option entails is key to selecting the best fit for your needs.

The first step is to assess your financial situation. Consider your budget, monthly income, and outgoings. This helps determine how much you can afford for monthly payments, which will guide your options.

Personal loans may be a suitable choice for those who want ownership of the vehicle right away. You borrow a lump sum and pay it back in installments, so you own the car once it’s paid off.

If you prefer lower payments but don’t want to own a car outright, you might consider leasing. Lease agreements typically have lower monthly payments compared to loans, allowing you to drive a new car without full ownership responsibilities.

It’s also important to review interest rates and terms of any finance offer. Shopping around for the best rates from various lenders can yield significant savings.

Additionally, consider your driving habits. If you drive a lot, a loan might be better because leases often include mileage limits. Understand these limits before deciding.

Lastly, think about the future implications of your choice. Factors such as potential resale value or wear-and-tear on a leased vehicle can affect your long-term finances. By reviewing each option carefully, you can choose the right car finance plan that aligns with your needs and financial goals.

Top Tips for Negotiating Car Finance Deals

Do Your Homework: Research current market rates and offers from different lenders. This gives you a strong position when negotiating.

Know Your Credit Score: A higher score often leads to better terms. If your score is low, consider improving it before applying for finance.

Compare Different Financing Options: Think about whether you prefer loans, leasing, or hire purchase options to focus your negotiations.

Be Clear About Your Budget: Decide how much you can afford to pay each month before negotiating to avoid overextending yourself.

Negotiate All Upfront Costs: Ask for discounts or waived fees on high quoted fees from dealers to save money.

Be Patient: Don’t rush. If you feel pressured, it is okay to walk away, as considering other options can lead to better offers.

The Impact of Credit Scores on Car Finance

Your credit score plays a significant role in determining the terms of your car finance. A higher credit score can result in lower interest rates, while a lower score may lead to higher rates or even rejection of your application.

When lenders assess your application, they look at your credit history, which reflects your ability to repay loans. This includes information like outstanding debts, payment history, and any defaults. A good credit score signals to lenders that you are a reliable borrower, leading to more favorable terms.

Many lenders consider scores in ranges, such as:

• 300-579: Poor

• 580-669: Fair

• 670-739: Good

• 740-799: Very Good

• 800-850: Excellent

If your score is in the lower range, do not worry. You can take steps to improve it by paying off existing debts, making timely payments, and avoiding new credit applications before seeking car finance.

In essence, understanding the impact of your credit score on car finance will empower you to make better financial decisions and secure the most advantageous loan or lease options.

Common Mistakes to Avoid with Car Finance

When dealing with car finance, it’s easy to make mistakes that can cost you money. Here are some common mistakes to avoid.

One major mistake is not doing your homework before applying. Understanding market rates and financing options helps you make informed decisions.

Another mistake is overlooking your credit score. Not knowing your score can lead to unexpected rejections or higher interest rates. Always check your score and take steps to improve it if necessary.

Many people also rush into agreements without reading the fine print. Ignoring terms and conditions can lead to hidden fees and unfavorable loan terms.

Additionally, it’s crucial to avoid maxing out your budget. Stretching your finances too thin can lead to payment difficulties. Stick to what you can afford to avoid future financial stress.

Lastly, skipping pre-approval for a loan can be a significant oversight. Getting pre-approved helps you know your budget and shows dealers you are a serious buyer. By avoiding these common mistakes, you can make your car financing experience smoother and more beneficial.

Exploring Online vs. Traditional Car Finance

When exploring online vs. traditional car finance, there are several key differences to consider. Online car finance is often more convenient, allowing you to compare options from multiple lenders quickly and easily. You can usually apply from the comfort of your home and receive approvals faster, often within hours.

One of the main advantages of online car finance is the ability to find competitive interest rates. Many online lenders offer lower rates since they have fewer overhead costs compared to traditional banks.

On the other hand, traditional car finance typically involves going to a local dealership or bank. This can offer a personal touch, as you can speak directly with a representative who can answer your questions and help guide you through the process.

Another important factor is customer service. While online lenders may be quick, they might lack the personalized assistance some borrowers prefer. If you face issues or have complex questions, dealing with a local bank might provide a better support experience.

In summary, both online and traditional car finance options have their pros and cons. Understanding these differences empowers you to choose the best financing method that suits your needs and preferences.

Future Trends in Car Finance to Watch

Future trends in car finance are shaping the way consumers approach vehicle purchases and financing options.

One significant trend is the rise of digital financing options, which allows customers to secure loans and leases online with ease, facilitating comparison of rates and finding the best deals.

Additionally, lenders are offering flexible financing solutions such as payment holidays and adjustable monthly payments based on individual financial circumstances, enhancing consumer management.

The use of AI in loan approvals is also emerging, with algorithms providing personalized financing options based on individual credit profiles, thus enhancing the borrowing experience.

Moreover, the popularity of green financing is increasing, particularly with the rise in electric and hybrid vehicle sales, offering special rates for eco-friendly car buyers.

Lastly, there is an exploration of blockchain technology for securing transactions and record-keeping, which fosters greater transparency and reduces fraud risks in car financing.

Navigating Car Finance Wisely

Understanding the nuances of car finance is vital for making informed decisions. From grasping the impact of credit scores to comparing online and traditional options, each element plays a crucial role in your financial journey.

Avoiding common mistakes and keeping an eye on future trends can help you secure the best deals while aligning with your financial goals. As the landscape of car finance evolves, being proactive and informed will empower you to navigate it successfully.

Whether you opt for a loan, lease, or another financing method, prioritize your needs and stay aware of all available options.