Finding the best medical insurance can feel daunting with the variety of options available. In today’s world, securing affordable health coverage is crucial for your well-being and financial stability.

As we dive into the ins and outs of medical insurance, you’ll learn about the types of plans, how to make informed comparisons, and essential features to consider.

Let’s unlock the secrets to finding the perfect plan for your needs.

Understanding Medical Insurance Basics

Understanding medical insurance is essential for everyone. It’s a way to help pay for healthcare services you may need. Medical insurance works by spreading the cost of care among groups of people. You pay a fee, often monthly, known as a premium, to your insurance company. In return, they help cover your medical expenses, which often include doctor visits, hospital stays, and surgeries.

Key Terms to Know

There are a few important terms to understand when looking at medical insurance:

- Premium: This is the amount you pay each month for your insurance.

- Deductible: The amount you must pay out of pocket before your insurance starts to cover costs.

- Co-pay: A fixed amount you pay for specific services, like visiting a doctor.

- Out-of-pocket maximum: The most you will pay for covered services in a year.

Why Medical Insurance is Important

Having medical insurance helps protect you from high medical costs. Without it, even a routine doctor visit could become very expensive. Insurance ensures that even in emergencies, you can receive care without the worry of large bills.

Enroll During Open Enrollment

Most health insurance plans have an open enrollment period. This is the time when you can sign up for a plan or make changes to your existing coverage. It usually happens once a year. Make sure to look out for this period and enroll on time.

In summary, having a good understanding of medical insurance basics can save you time and money. Whether you are single, a family of four, or a small business owner, knowing how medical insurance works is vital.

Types of Medical Insurance Explained

There are several types of medical insurance that cater to different needs and situations. Knowing these can help you make the best choice for your health needs.

Health Maintenance Organization (HMO)

An HMO plan usually requires you to choose a primary care doctor. This doctor coordinates all your healthcare needs. Referrals to specialists are needed to get coverage.

PPO (Preferred Provider Organization)

PPO plans offer more flexibility when you choose healthcare providers. You can see any doctor or specialist without a referral. However, staying in-network will save you money.

Exclusive Provider Organization (EPO)

EPO plans are similar to PPOs but usually do not cover any care outside the network, except in emergencies. You have the freedom to choose providers, but you must use in-network services for full benefits.

Point of Service (POS)

A POS plan combines features of HMOs and PPOs. You choose a primary doctor and need referrals, but you can also see out-of-network providers at a higher cost.

Catastrophic Health Insurance

Catastrophic plans are designed for young and healthy individuals. They typically have low premiums but high deductibles, providing coverage mainly for severe illnesses or accidents.

High-Deductible Health Plan (HDHP)

HDHPs have higher deductibles than other plans but often come with lower premiums. They can be paired with Health Savings Accounts (HSAs) to save for medical expenses tax-free.

Medicare and Medicaid

Medicare is a federal health insurance program for people aged 65 and older, while Medicaid is a state and federal program that assists low-income individuals and families with medical costs.

Understanding these types of medical insurance will help you identify which plan aligns best with your healthcare needs and financial situation.

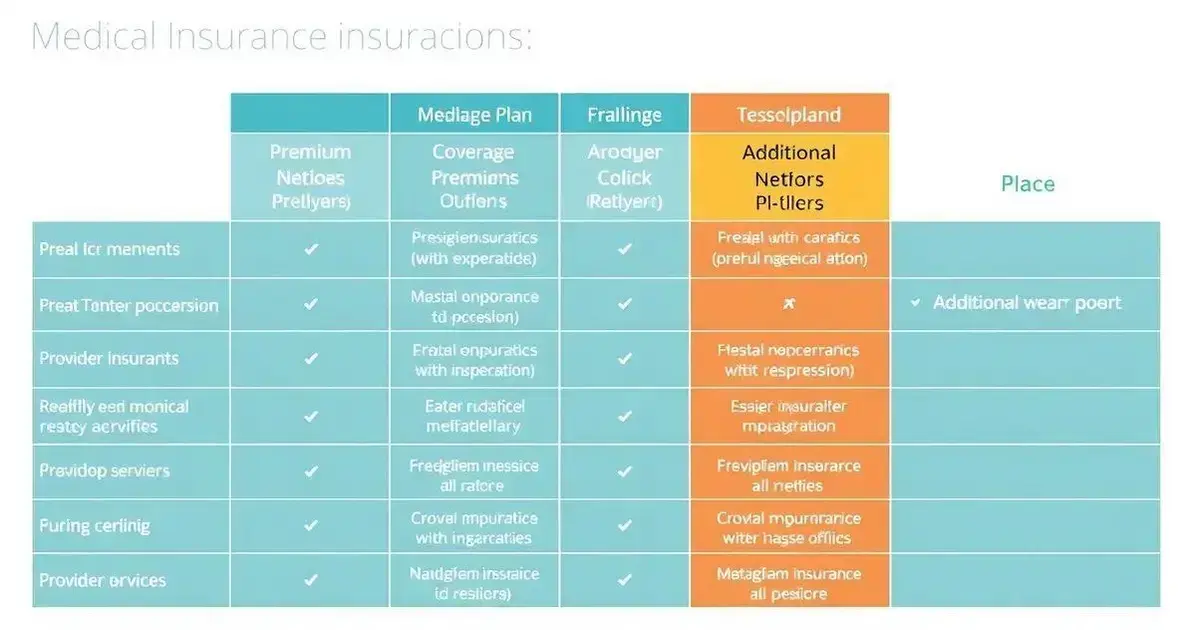

How to Compare Medical Insurance Plans

Comparing medical insurance plans can be challenging. By following some simple steps, you can make the best choice for your healthcare needs.

Step 1: List Your Healthcare Needs

Start by making a list of your specific healthcare needs. Think about regular medications, doctor visits, and any planned procedures. This helps you determine what type of coverage you will require.

Step 2: Check the Provider Network

Look at the doctor and hospital networks each plan offers. Make sure your preferred doctors and facilities are included. Using in-network care usually saves you money.

Step 3: Compare Premiums and Out-of-Pocket Costs

Review the monthly premium, which is what you pay each month for insurance. Also, consider deductibles, co-pays, and coinsurance. Calculate the total annual costs to see what fits your budget.

Step 4: Look at Coverage Details

Examine what each plan covers. Check for key services like preventive care, mental health services, and emergency care. Understanding coverage limits is essential.

Step 5: Review Additional Benefits

Some plans offer extra benefits, such as wellness programs, gym memberships, or discounts on certain services. These can add value to your insurance plan.

Step 6: Read Reviews and Ratings

Search for reviews and ratings from current and past policyholders. Look for insights on customer service, claims processing, and overall satisfaction. These can help you gauge the reliability of the insurance company.

Step 7: Get Help if Needed

If comparing plans feels overwhelming, consider consulting with a licensed insurance agent. They can help explain your options and guide you toward the right choice.

Top Features to Look for in Medical Insurance

When choosing medical insurance, it’s important to know which features matter most. Here are some top features to look for:

1. Comprehensive Coverage

Make sure the plan covers a wide range of services, including preventive care, emergency services, hospitalization, and prescription drugs. The broader the coverage, the better protected you will be.

2. Low Out-of-Pocket Costs

Look for plans with low deductibles and co-pays. This means you will pay less when you receive care. Aim for a plan that balances premium costs with your expected healthcare needs.

3. Quality Network of Providers

Check that the insurance plan includes a quality network of doctors and hospitals. Make sure your preferred providers are in-network to save on costs.

4. Flexible Plan Options

Some insurance companies offer a variety of plans to choose from. This flexibility lets you select the coverage that best suits your health needs and financial situation—an important step in finding the best medical insurance for you.

5. Preventive Care Services

Good health insurance allows you to access preventive services without additional costs. These may include vaccinations, screenings, and annual check-ups. Preventive care can help you avoid serious health issues.

6. Prescription Drug Coverage

Ensure that the plan covers necessary medications. Look at the formulary (list of covered drugs) to see if your prescriptions are included and what your costs will be.

7. Customer Service Support

Strong customer support is crucial. Look for an insurance provider that has a reputation for good customer service, allowing you to get help when needed.

By focusing on these key features, you’ll be well on your way to choosing the best medical insurance to support both your health and your budget.

Tips for Choosing the Best Medical Insurance

Choosing the best medical insurance can be overwhelming. Here are some helpful tips to guide you:

1. Assess Your Healthcare Needs

Before looking at plans, take time to understand your healthcare needs. Consider how often you visit the doctor, if you have any chronic conditions, or if you take regular medications.

2. Evaluate Your Budget

Determine how much you can afford for monthly premiums and out-of-pocket expenses. Make sure to factor in potential costs for doctor visits and medications to find a plan that fits your financial situation.

3. Research Plan Types

Understanding the different types of medical insurance, like HMOs, PPOs, and EPOs, will help you decide which plan suits you best. Choose one that offers the flexibility and coverage you need.

4. Check Provider Networks

Look for plans that include your preferred doctors and hospitals in their network. Using in-network providers usually saves you money on healthcare costs.

5. Read Reviews and Ratings

Search online for reviews about different insurance companies and their plans. Look for ratings on customer service and claims processing, as these can impact your experience.

6. Consider Family Needs

If you have a family, make sure the plan covers everyone’s needs. Check if there are pediatric services for children, mental health coverage, and preventive care options for all ages.

7. Don’t Skip the Fine Print

Read the policy details carefully. Pay attention to terms and conditions, coverage limits, and any exclusions. Understanding what is and isn’t covered can save you from unexpected costs later.

By following these tips, you’ll be better equipped to choose the best medical insurance plan for your health, your budget, and your peace of mind.

Common Medical Insurance Myths Debunked

Many people have misconceptions about medical insurance. Here are some common myths debunked:

Myth 1: I Don’t Need Insurance If I’m Healthy

This is false. Even healthy individuals can face unexpected medical emergencies or illnesses. Having insurance protects you from high costs.

Myth 2: Medical Insurance Covers Everything

Not all plans cover every service. Most insurance has specific exclusions and limitations. Always read the details to know what is covered.

Myth 3: I Can’t Get Insurance If I Have a Preexisting Condition

Under the Affordable Care Act, insurers cannot deny coverage based on preexisting conditions. This means everyone is eligible for health insurance.

Myth 4: All Insurance Plans Are the Same

Insurance plans vary significantly in coverage, costs, and provider networks. It’s important to compare plans to find one that best meets your needs—and to identify the best medical insurance options available for your circumstances.

Myth 5: I’ll Be Penalized for Not Having Insurance

While there were penalties in the past, these have been removed in many states. However, it’s still wise to have insurance to avoid high medical costs.

Myth 6: Insurance Only Benefits the Sick

Insurance can help everyone, not just those who are ill. It offers preventive care, like vaccinations and check-ups, which keep you healthy.

Myth 7: I Can Sign Up for Insurance Anytime

Insurance enrollment typically has specific open enrollment periods. Missing these deadlines can mean waiting until the next enrollment period to apply.

By understanding these myths, you can make more informed decisions and choose the best medical insurance plan that fits your lifestyle and healthcare needs.

The Importance of Regularly Reviewing Your Medical Insurance

Regularly reviewing your medical insurance is an essential practice that can lead to better health and financial outcomes. Here are key reasons why you should make this a priority:

1. Changes in Personal Needs

Your health needs may change over time. If you have a new medical condition or develop a chronic illness, you may need different coverage to meet those needs effectively.

2. Policy Changes

Insurance companies often change their policies, which can affect coverage options, premiums, and co-pays. Regularly reviewing your plan helps you stay informed about these changes.

3. Evaluate Cost-Effectiveness

By reviewing your plan, you can assess whether it remains a cost-effective option. You may find other plans that offer better coverage for a similar or lower premium.

4. Take Advantage of New Benefits

Insurance providers frequently update their offerings. You could benefit from new wellness programs, preventive services, or discounts that you may not be aware of if you don’t review your policy regularly.

5. Find Better Networks

Doctor networks can change as insurance companies update their agreements. Regular reviews allow you to confirm that your preferred medical providers are still in-network.

6. Ensure Compliance with Laws

Healthcare regulations can change, and your insurance must comply with them. Regular reviews ensure that your plan meets legal requirements and protects you from penalties.

7. Peace of Mind

Lastly, knowing that you have the best medical insurance for your needs provides peace of mind. Regular reviews allow you to confirm that you’re making the most informed decisions for your health insurance.

Making it a habit to review your best medical insurance plan annually—or whenever your health needs change—can empower you to make the best choices for your healthcare journey.

In Summary: Finding the Best Medical Insurance

Choosing the best medical insurance is a crucial decision that can significantly impact your health and financial well-being. Understanding the basics of medical insurance, the various types available, and the features to look for is essential.

By considering tips for choosing the right plan and debunking common myths, you can make an informed decision that aligns with your healthcare needs and budget.

Additionally, regularly reviewing your medical insurance not only keeps you updated on changes that may affect your coverage but also ensures that you are getting the most value for your money.

With the right research and consideration, you can unlock affordable health coverage options that best suit your lifestyle and future health requirements.